vanguard high yield tax exempt fund state tax information

Investment market cap and category. Learn about the funds agencies rating and risk rating transparent information about the funds management personal policies of invested allocation and diversification past performance.

Vwalx Vanguard High Yield Tax Exempt Fund Admiral Shares Vanguard Advisors

Learn about the funds agencies rating and risk rating transparent information about the funds management personal policies of invested allocation and diversification.

. Investment market cap and category. Find basic information about the Vanguard High-yield Tax-exempt Fund Admiral Shares mutual fund such as total assets risk rating Min. Vanguard High-Yield Tax-Exempt Bond is relatively conservative compared to other muni strategies sporting the high-yield label so much so that it lands in the muni national long Morningstar.

Tax-exempt interest dividends by state for Vanguard municipal bond funds and Vanguard Tax-Managed Balanced Fund Important tax information for 2017 This tax update provides information to help you report earnings by state from any of your Vanguard municipal bond funds and Vanguard Tax-Managed Balanced Fund on your year-end tax returns. A high correlation between funds may mean that your portfolio of funds is not as diverse as you might want it to be. Tax-exempt interest dividends from these funds as reported on Form 1099-DIV Box 11 are taxed differently at the federal state and local levels.

Find the latest Vanguard High-Yield Tax-Exempt Fund Admiral Shares VWALX stock quote history news and other vital information to help you with your stock trading and investing. Tax-exempt interest dividends by state for Vanguard municipal bond funds and Vanguard Tax-Managed Balanced Fund Important tax information for 2020 This tax update provides information to help you report earnings by state from any of your Vanguard municipal bond funds and Vanguard Tax-Managed Balanced Fund on your year-end tax returns. Knowing this information might save you money on your state tax return as most states dont tax their own municipal bond distributions.

Important tax information for 2021 This tax update provides information to help you report earnings by state from any of your Vanguard municipal bond funds and Vanguard Tax-Managed Balanced Fund on your year-end tax returns. Vanguard High-Yield Tax-Exempt Fund 386 612 547 494 643 Calendar Year Returns25 AS OF 1312022 2018 2019 2020 2021 2022 Vanguard High-Yield Tax-Exempt Fund 129 917 539 386 -269 BBg Muni 128 754 521 152 -274 Muni National Long 027 837 536 288 -318 Top 10 Holdings7 AS OF 12312021 PUERTO RICO SALES. Find basic information about the Vanguard High-yield Tax-exempt Fund mutual fund such as total assets risk rating Min.

Although the income from municipal bonds held by a fund is exempt from federal tax you may owe taxes on any capital gains realized through the funds trading or through your own redemption of shares. While other tools may compare funds only to the SP 500 or 500 Index fund you can use this tool to determine how closely the performance of one Vanguard stock fund tracks that of any other Vanguard stock fund. Vanguard High-YieldTax-Exempt Fund Investor Shares Return BeforeTaxes 539 485 564 Return AfterTaxes on Distributions 533 482 562 Return AfterTaxes on Distributions and Sale of Fund Shares 453 456 530 Vanguard High-YieldTax-Exempt Fund Admiral Shares Return BeforeTaxes 547 494 572 Bloomberg Barclays Municipal Bond Index.

PDF January 15 2021. Tax-exempt interest dividends by state for Vanguard Municipal Bond Funds and Vanguard Tax-Managed Balanced Fund View tax-exempt interest dividends earned by the funds in each state or US. For some investors a portion of the funds income may be subject to state and local taxes as well as to the federal Alternative Minimum Tax.

Muni National Long Previous Close. Utah-specific taxation of municipal bond interest To help you prepare your state income tax return were providing the percentage of federal tax-exempt interest income thats subject to individual income tax in Utah for each Vanguard fund that. Analyze the Fund Vanguard High-Yield Tax-Exempt Fund having Symbol VWAHX for type mutual-funds and perform research on other mutual funds.

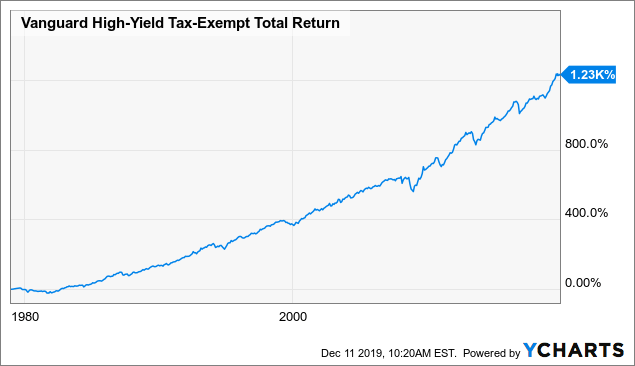

VanguardHigh-Yield Tax-Exempt Fund Bond fundAdmiral Shares Fund facts Risk level Low High Total net assets Expense ratio as of 022621 Ticker symbol Turnover rate Inception date Fund number 12345 16822 MM 009 VWALX 108 111201 5044 Investment objective Vanguard High-Yield Tax-Exempt Fund seeks to. The fund has returned 496 percent over the past year 648 percent over the past three years 566 percent over the past five years and 512 percent over the past decade. Learn more about mutual funds at.

Vwahx Vanguard High Yield Tax Exempt Fund Class Info Zacks Com

Vanguard Tax Exempt Etf Nysearca Vteb For Investors Wanting Quality Without Leverage Seeking Alpha

Vwahx Vanguard High Yield Tax Exempt Fund Investor Shares Vanguard Mutuals Funds Investing Money Fund

Tax Information For Vanguard Funds Vanguard

Vwahx 41 Years Of High Yield Municipal Income For Retirement Mutf Vwahx Seeking Alpha